Exion Edge links individuals enthusiastic about the investment landscape with investment education firms. These suitable firms offer education that may aid in one’s investment journey. Those who are completely new to investments can also register with Exion Edge. The firms Exion Edge assigns offer deeper insights into investment concepts. Exion Edge engineers this connection free of charge, enabling quick access to investment education.

Yes, one can learn about investments online, but instead of hitting terrible roadblocks while learning, connecting to an investment education firm may speed up the learning process. These firms have personalized educational plans for Exion Edge users.

Getting connected can not get easier than it already is. Exion Edge’s registration is quick and easy. All that is needed is to provide the required information and complete the registration within minutes. Interested? Read on to learn how to get registered on Exion Edge.

To begin the educational journey, individuals can visit Exion Edge’s website to register. The registration is not lengthy and can be completed very quickly.

After the registration has been completed, new Exion Edge users are handed over to the investment education company. These companies are waiting to meet the user, get acquainted, and plan their education.

The data obtained from the users’ registration is used to connect them to personalized education firms. Read on to learn about the full Exion Edge package.

After the new Exion Edge user has been connected after completing the previous steps above, the educational firm will send a representative to meet the user to discuss their education.

The educational firms have special approaches to teaching and several resources. The user will be allowed to ask questions and familiarize themselves with the organization. Get registered with Exion Edge to begin.

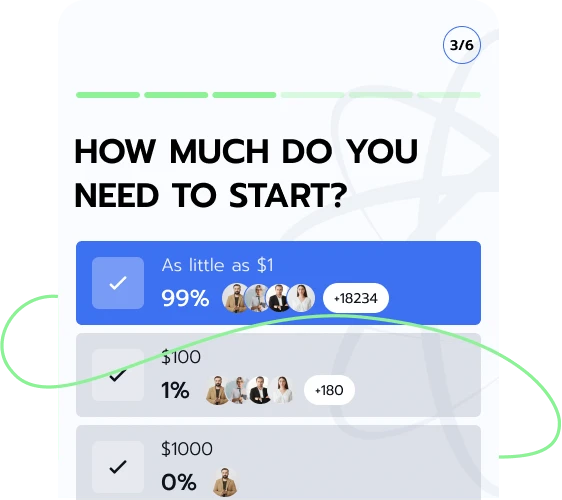

Exion Edge does not request any form of payment in registration or membership. There are no subscription plans or hidden charges either. Individuals can proceed to register without worries.

Exion Edge does not discriminate or choose its users based on any bias or country. People from anywhere across the globe can register with Exion Edge and connect to investment education.

Exion Edge ensures its website is easy to navigate to make sure users can get registered quickly and without any hassle or discomfort.

This is the measure or the extent of how different types of investment relate to one another. If two assets move in the same direction simultaneously, they are positively correlated. But, if they move in opposite directions simultaneously, their correlation is negative. Understand the differences after registering with Exion Edge.

Some pairs of assets cannot correlate with each other. This means that they neither move together nor against each other. Hence, they have zero correlation. Eager to know more? Get registered on Exion Edge.

When building an investment portfolio, it is essential to understand and capitalize on asset correlation. It may be vital to include assets with low or negative correlations. This is done because low-correlation assets may help to balance risk, and holding higher-correlated assets may invite more risk. Learn more about asset allocation after registering with Exion Edge.

A mathematical equation is used to calculate the correlation between two or more assets. Most times, the formula used applies the covariance and standard deviation of each asset being calculated. Asset correlation is measured on a scale of -1.0 to +1.0. This can measure how closely the movement of the assets is. However, there is a more straightforward way to measure asset correlation, which is using an asset correlation calculator online.

There are three major examples of this concept. As briefly introduced earlier, there are negative correlations, positive correlations, and no correlations at all. Understanding how these concepts affect investments and one’s portfolio may be vital when navigating investments. Read more to get more info. Interested? Get registered with Exion Edge to learn more.

Negative Correlation

Here, assets will be further apart from each other and tend to generally move in opposite directions. If two assets are strongly correlated negatively, if one asset accumulates by 5%, the other would lose exactly 5%.

Positive Correlation

Naturally, assets within the same industry would most likely correlate positively. This is due to the fact that they are affected by similar market factors or conditions, and the more closely correlated they are, the more similar their movement and directions are.

Zero/No Correlation

If two assets do not correlate whatsoever, it means they’ve independent trends. In this particular case, it is extremely difficult to predict the movement of one asset based on the movement of the other.

A key understanding of asset correlation may help individuals manage their portfolios and balance risk. Get registered with Exion Edge to connect with firms that offer more information on asset correlation.

These two concepts are closely related, and modern portfolio theory relies on the premise that different investments have different relationships with each other. This theory is a classic investment strategy that seeks a balance between returns and risk. It hampers the consequence of diversification to mitigate portfolio risk. To learn more about these concepts, register with Exion Edge.

This is the quotation of two currencies. The value of one currency, the first–which is called the base currency, is quoted or compared against the second–the quote currency. This pair indicates just how much the quote currency is needed to purchase a single unit of the base currency. Intrigued? Learn more through Exion Edge.

Currency pairs are the foundation of the foreign exchange market. Currency pairs are traded during forex market trading sessions. A currency pair is written in AAA/BBB format. There are three main categories of currency pairs: major pairs, minor pairs, and exotic pairs.

Major pairs are the most commonly traded, as the name implies, and this is because of the high rates of liquidity and low spreads. Individuals interested in investments can learn more about currency pairs and how they interact with the foreign exchange market after registering with Exion Edge.

To navigate the foreign exchange market, traders need to understand currency pairs, their relation to bid-ask spread, liquidity, volatility, and many other factors. As the basis of foreign exchange trade, currency pairs are crucial points to grasp.

There are a couple of commonly used terms that indicate certain currency pairs. These terms are said in passing and may not be understood by novice traders. Get registered on Exion Edge to learn more.

This currency pair depicts the relationship between the United Kingdom and the United States. The exchange rate in this pair reflects the strength of the two economies and is often impacted by economic forces.

This pair is sensitive to economic factors like global commodity prices. The GDP and the statistics for employment in Canada (the quote pair) can affect the pair’s movement in the market.

It is the most liquid forex pair. It has a very tight spread and is a favorite among institutions and individual traders all the same. Economic factors can also create fluctuations in its exchange rate.

Traders who trade Kiwi often keep an eye out for news from the Reserve Bank of New Zealand (RBNZ), as economic reports might give insights into its potential direction.

AI was initially a myth seen in movies, but through technological advancements, the promise AI holds is now bewildering. It has been introduced into many sectors, and investments are one of them.

Artificial intelligence is now making multi-dollar investment decisions within seconds. Some wonder if this is the avenue to unlock shocking returns. That remains to be seen, but the promise is still there. Get registered with Exion Edge to learn more about AI-powered investing.

Human beings are prone to error and emotional bias. Fortunately, artificial intelligence does not present itself with these problems. Due to this, many individuals have turned to AI for a more efficient decision-making model. The AI tools used today can navigate investments and make use of historical data to conduct analysis. Some rely on this to make informed decisions.

AI is no longer a feature reserved for tech giants and hedge fund analysts. The algorithms used by machine learning models can now predict market trends, help allocate portfolios, manage risk, and even offer advice. Notwithstanding, the question of their long-term impact on the market is still there. Followed by the observation of how AI would reshape investments. Intrigued by this? Use Exion Edge and get to learn all about it.

The practicality and utilization of AI models are interesting aspects of investments that individuals can explore. To have sufficient information on the use and application of AI in investments, individuals can seek investment education through educational firms connected by Exion Edge.

Exion Edge, in conjunction with investment education firms, works hand in hand to offer its users suitable investment education. These firms connected through Exion Edge are ready to impart their knowledge to individuals interested in investments. There are concepts in investing that may not be understood without education. To this end, Exion Edge connects its users to investment education to ensure they become more knowledgeable in finance.

Here, computers analyze historical data and understand it, and with that, they learn from it to enable them to predict future trends in the market, forecast stock prices, or assess risk.

This is a digital space that provides automated and algorithm-driven financial planning and investment services. They are targeted at individuals with limited financial knowledge.

NLP is a form of AI that enables machines to interpret, analyze, and generate human speech. They can also be used to analyze financial news and reports to predict the market.

AI can make use of data to make decisions. Compared to humans, instead of using instinct, gut feeling, and the like, AI processes large amounts of data to guide investment strategies.

AI can use machine learning and customized techniques to monitor the condition of the market, assess stock performance, improve diversification, and adjust portfolios in real time.

AI uses assessment models to diagnose potential risks associated with an investment. These models can also evaluate the liquidity and volatility of the market. This can aid individuals in understanding potential risks and to adjust their portfolios accordingly.

To make informed decisions, it is obvious that one needs to be informed. In investments, new concepts are emerging continuously, and without sufficient information on concepts, it may be difficult to navigate investments.

One needs to know enough to see through all the noise. With Exion Edge, individuals get investment education from suitable tutors.

| 🤖 Registration Cost | Free |

| 💰 Fees | No Fees |

| 📋 Registration | Simple, quick |

| 📊 Education Focus | Cryptocurrencies, Forex, Mutual Funds, and Other Investments |

| 🌎 Supported Countries | Most countries Except USA |